First Choice For

Banking & Finance

Digital transformation, efficiency, big data, scalable architecture & the ability to parameterize to stay in competition.

- Efficiency

- Flexibility

- Security

Banking & Finance Solution

What is ECOru ?

ECOru offers businesses the opportunity to create new distribution channels, innovative products, cost effective service delivery and provide better customer experience.

Cloud Platform

True Cloud Native Platform

Cloud technology enables your financial institution to be ready for the future always.

- Future-ready with cloud technology

- Mitigate business risks

- Minimize downtime, ensure continuity

- Enhance data security, reduce costs

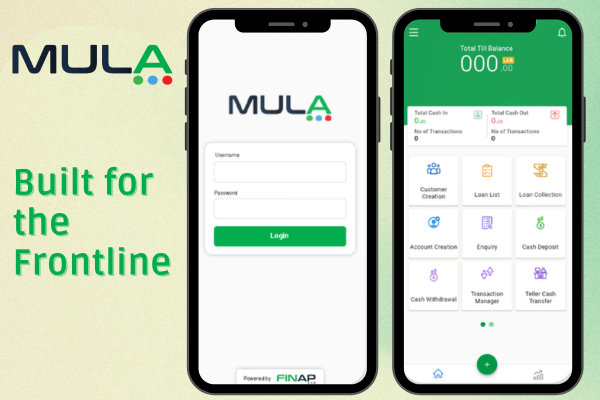

Mobilize Field Agents

Digitize traditional banking, empower remote access, and expand agent reach for easy accessibility.

Award Winning Solution

ECOru has been recognized both globally for being an advanced fintech product and an innovative cloud solution.

How ECOru Works

Streamlining Your Banking Operations

The seamless process of ECOru, from data integration to customization, ensuring efficient and secure banking & financial solutions tailored to your business needs.

Data Migration

Effortless data migration ensuring a quick and hassle-free transition to ECOru's system.

Tailored Solutions

Customize ECOru to match your business needs, from loan terms to user permissions.

Simple Navigation

User-friendly interface guarantees effortless navigation to customer profiles, transactions, and reports.

Deployment Options

Choosing an Implementation Method

ECOru can be implemented both on-premise & cloud. We recommend that you use a cloud solution due to its low cost, high availability & security.

On-Premise Deployment

Traditional Setup, Ongoing Maintenance

Following the traditional method requires setting up ECOru on your own servers, requiring ongoing costs for maintenance, upgrades, and IT management tasks. As you grow so will your expenses.

Cloud Deployment

Cost-Effective, Secure Solution

Choose cloud hosting for ECOru on platforms like Azure, AWS, or GCP. Benefit from lower costs, high availability, and enhanced security. Pay-as-you-go model scales with your needs.

ECOru Modules

Integrated Banking Solutions

Streamline Operations with Customizable Modules for Loans, Savings, Customer, Cash, Payment, and More

Testimonials

Here's What Our Clients Have To Say

Firsthand experiences and success stories shared by our valued clients.

We have made the right decision by selecting ECOru since it gives us the flexibility of monthly payments, and we do not have to spend our valuable capital on expensive hardware, because all our data is highly secured on the cloud. I must add, MULA, the ‘field agent App’ has given us so much reach and scale empowering us to give our customers an excellent experience in working with us

Get Started

Try ECOru for Free

Experience the power of ECOru with our free demo. Enter your email below to request a demo.

In 2022, LOTIC Group of Companies Board made the strategic decision to venture into Banking & Finance, establishing a licensed Micro Bank in Western PNG. Following a detailed evaluation, Fintechnology Asia Pacific Lanka (Pvt) - FINAP and its CORE banking system ECOru were selected. We have full confidence in FINAP’s expertise and recommend FINAP as a reliable solution.